Money today. Credit for the future.

Instant cash and credit with no minimum credit score or security deposit to qualify.

As Seen In

Get the money

you need

today

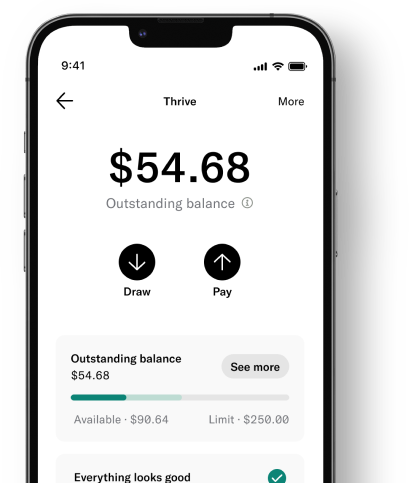

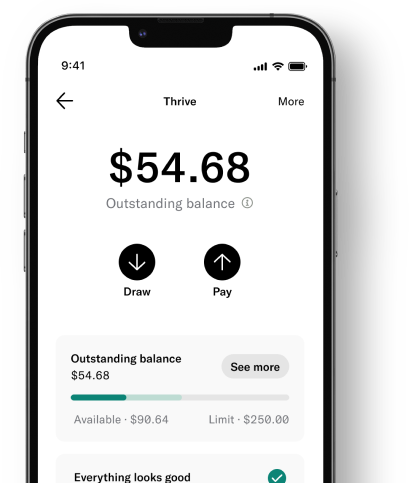

Thrive

line of credit ^

New

Start with $250 and build your credit history. No minimum credit score to qualify.

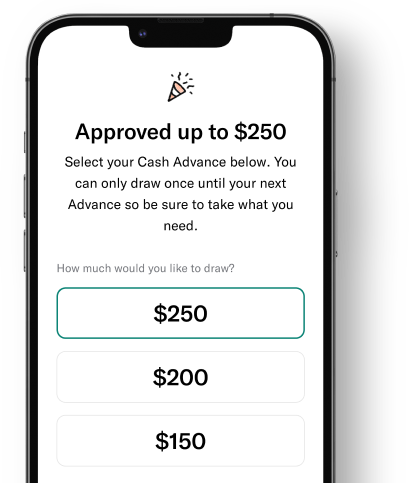

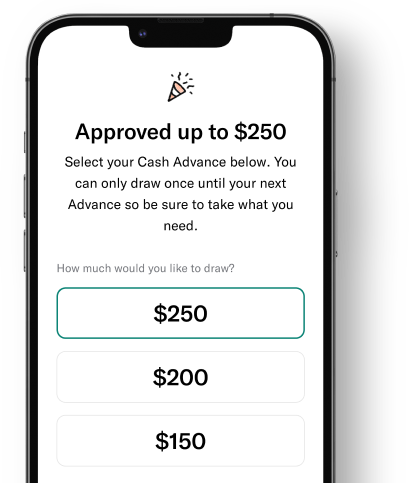

Cash Advance

Get up to from $10-$300 instantly* with no interest, no late fees, and no impact to your credit score.

Strive for the

money

you want

tomorrow

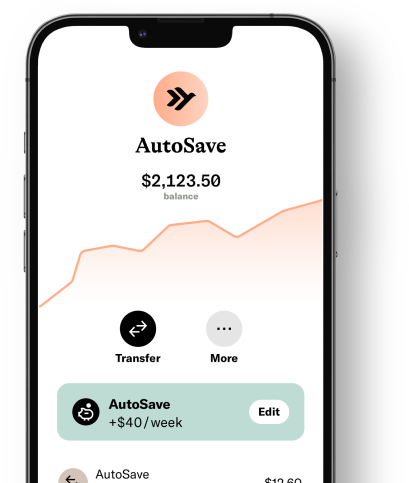

Automatic Savings^^

Leave it to us to help you figure out when and how much you can save. Kick back and relax.

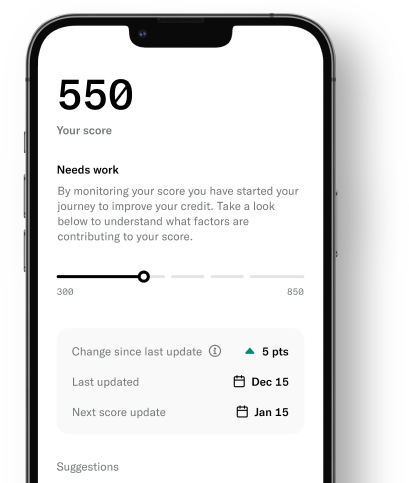

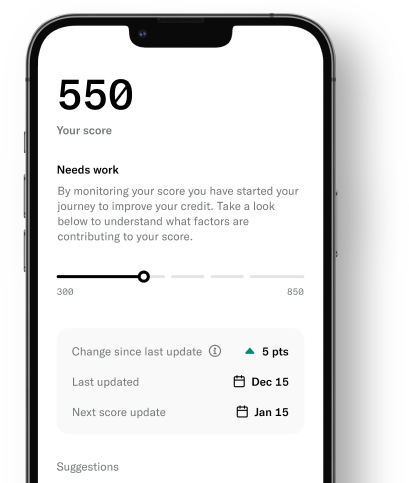

Credit Monitoring

Stay on top of your credit score. The bureaus keep tabs on you. You should keep tabs on them.

Spend Tracking

Personalize your budgeting categories and set weekly or monthly caps. Know when to say no.

Join Empower

Stop stressing and start living.

Empower is a financial technology company, not a bank. Banking services provided by nbkc bank, Member FDIC. Empower Thrive provided by FinWise Bank, Member FDIC.

Empower offers a 14-day free trial for first-time customers only. Once the free trial concludes, Empower charges an auto-recurring $8 per month subscription fee. If you do not wish to pay the subscription fee, you must cancel your Empower subscription before the end of your free trial. If you are a returning customer, you will be charged the $8 fee immediately upon resubscribing.

* Subject to approval. Instant delivery fees may apply. See Empower’s Terms for current instant delivery fee amounts.

^ Subject to credit approval. Access to Thrive requires Empower membership of $8 per month. Customers who open a Thrive line of credit will not be eligible for Cash Advance while the line of credit account is open.

† We report your payments to the credit bureaus. Failure to make your monthly minimum payments by the payment due date each month may result in negative reporting to the credit bureaus, which may negatively impact your credit score.

‡ If you apply for a Thrive line of credit, we perform a soft inquiry on your credit report, which does not impact your credit score.

^^ If you sign up for Automatic Savings, you are required to open a deposit account in your name through nbkc bank, Member FDIC. Any balances you hold with nbkc bank, including but not limited to those balances held in Empower accounts are added together and are insured up to $250,000 per depositor through nbkc bank, Member FDIC. nbkc bank utilizes a deposit network service, which means that at any given time, all, none, or a portion of the funds in your Empower accounts may be placed into and held beneficially in your name at other depository institutions which are insured by the Federal Deposit Insurance Corporation (FDIC). For a complete list of other depository institutions where funds may be placed, please visit https://www.cambr.com/bank-list. Balances moved to network banks are eligible for FDIC insurance once the funds arrive at a network bank. To learn more about pass-through deposit insurance applicable to your account, please see the Account Documentation. Additional information on FDIC insurance can be found at https://www.fdic.gov/resources/deposit-insurance/.